Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAfter bonds, equities expected to shine next year amid ease in trade war

The Jakarta Composite Index (JCI) is expected to rise to between 7,000 and 7,200 next year, driven by the increase in prices of shares in promising business sectors

Change text size

Gift Premium Articles

to Anyone

A

nalysts recommend securities as good investments next year as the expected easing of the trade war between the United States and China and the recovery in the country’s business activities as a result of the government’s stimulus program will restore positive sentiment in the local stock market.

Commonwealth Bank’s Indonesia head of wealth management and client growth, Ivan Jaya, said that stocks and equity funds would follow the success of bonds and could become interesting instruments for investment in the country in 2020.

“The rule of thumb on investment in Indonesia is that after a bond rally, stocks will follow,” he said in a press briefing in Jakarta on Wednesday.

Ivan said that while investments in stocks and equity funds struggled this year, investments in bonds thrived, with a year-to-date net inflow of almost Rp 120 trillion (US$8.5 billion). The Bloomberg Indonesia Local Sovereign Bond (BINDO) index also showed a year-to-date total return increase of 13.74 percent as of Tuesday.

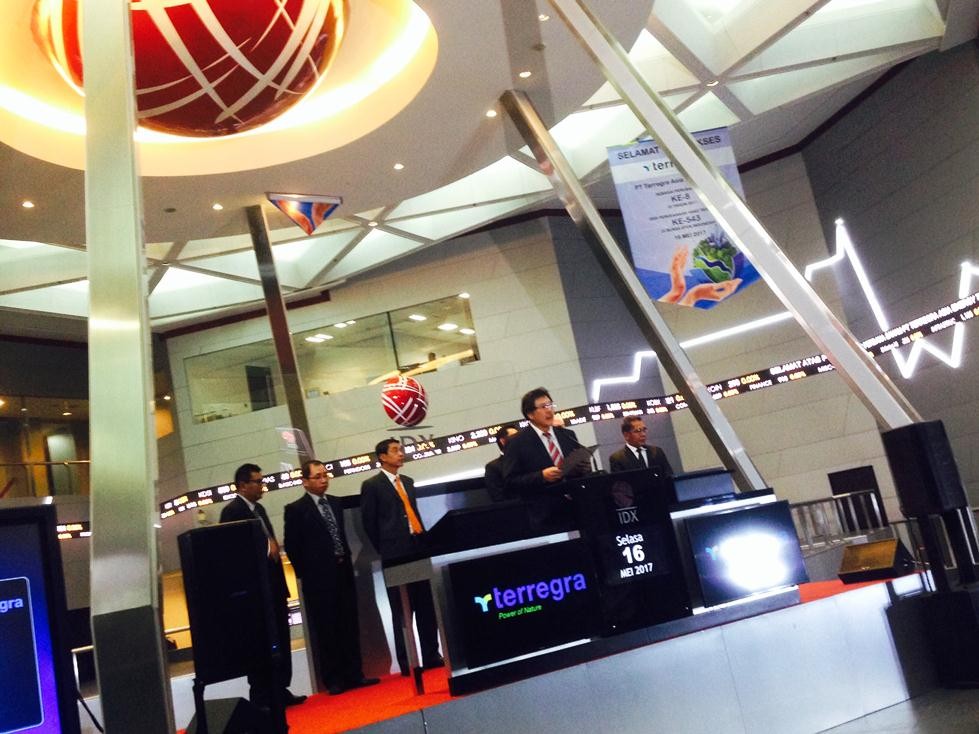

Speaking at the same event, PT Sucorinvest Asset Management president director Jimmy Paul Wawointana forecast that the Jakarta Composite Index (JCI), the main price benchmark of the Indonesian Stock Exchange (IDX), would rise to between 7,000 and 7,200 next year, driven by the increase in prices of shares in promising business sectors.

The share price performance on the IDX has been relatively stagnant this year. The JCI closed at 6,170 on Thursday, a slight increase from 6,110 at the end of 2018.

Next year’s most promising business sectors for stock investments are banking in the financial sector, cigarettes in the consumer goods sector, nickel in the mining sector and crude palm oil (CPO) in the agricultural sector, he said.