Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsPreventing circumvention of AEOI obligations

A core element in ensuring effective implementation of the Automatic Exchange of Financial Account Information (AEOI) is that participating jurisdictions shall put in place anti-abuse rules to prevent any practices intended to circumvent the reporting and due diligence procedures.

Change text size

Gift Premium Articles

to Anyone

The multilateral competent authority agreement on the Automatic Exchange of Financial Account Information (AEOI) is the multilateral framework that facilitates the AEOI. To date, there are 123 signatory jurisdictions of the agreement, 117 of which have effectively implemented the exchange while the remaining six have stated their intention to first exchange the information either in 2024, 2025, or 2026.

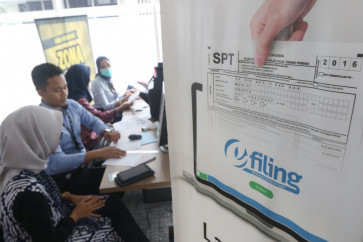

Indonesia started exchanging financial information automatically in 2018. Ever since, on an annual basis Indonesia, through the Taxation Directorate General,sends reports to all jurisdictions that have an activated exchange agreement with Indonesia (participating jurisdictions).

The reports contain financial information of participating jurisdictions’ tax residents who hold financial assets in financial institutions that carry out depository, custodial, investment and specified insurance activities in Indonesia. Likewise, Indonesia receives reports from all participating jurisdictions containing financial information of Indonesians tax residents who hold financial assets in the partner jurisdictions.

The reports should at least cover some information namely the identity of the financial account holder, the financial account number, the identity of the reporting financial institution, the balance or value of the financial account and the income derived from the financial account. Such information is then entered into the database of the recipient country’s tax authority, the Taxation Directorate General in Indonesia, to further be used in activities to increase tax compliance and to explore potential tax revenues.

In his tax report to Group of 20 leaders in September 2023, the Organization for Economic Co-operation and Development (OECD) secretary-general stated that in 2022, the AEOI scheme exchanged information on over 123 million financial accounts worldwide, covering total assets of above 12 trillion euros (US$13.3 trillion).

Considering that the exchange is carried out between tax authorities and each tax authority conducts validation in accordance with the applicable international standards, the information has high validity. Therefore, the data obtained through the AEOI is powerful in increasing tax compliance, including suppressing cross-border tax evasion.

In a recently published report, the EU Tax Observatory affirmed that the AEOI had drastically reduced offshore tax evasion. More precisely, it estimated that offshore tax evasion had declined by a factor of about three as a result of the AEOI implementation.