Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe property tax hassle that put Pati's regent in trouble

Greater autonomy awarded to regional governments has not been matched by adequate financial independence.

Change text size

Gift Premium Articles

to Anyone

T

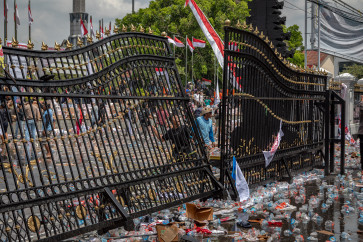

he brewing tension in Pati Regency, Central Java, where massive protests erupted against a staggering 250 percent hike in property tax (PBB) covering land and buildings, was not only simple outrage about a tax rate.

The massive protests were also a cry against a system where local taxation feels more like an imposed burden than a shared investment in community development. This flashpoint exposed a deeper problem, whereby most of Indonesia's provinces and regencies remain fiscally shackled to Jakarta decades after decentralization began, with local tax collection, a supposed pillar of autonomy, still weak, inconsistent and underutilized.

Since the implementation of regional autonomy in the early 2000s, local governments have enjoyed greater authority over budgeting and development decisions. However, that autonomy has not been matched by adequate financial independence.

Most local governments still rely on transfers from the central government in Jakarta in the forms of general allocation funds (DAU) and special allocation funds (DAK) for funding the bulk of their expenditures. In many regions, genuine own-source revenue which includes local taxes such as PBB tax and retributions, contributes less than 25 percent of total revenue.

This creates a paradox. Regions are expected to take charge of local development, yet they remain financially dependent on Jakarta. The ability to raise and manage local taxes should be the foundation of regional empowerment. But in practice, local tax instruments are often poorly administered, underutilized or overly centralized in regulation.

For example, local governments cannot freely set tax rates or create new tax types without approval from the central government. This constraint severely limits their flexibility and innovation.

Local governments should avoid imposing property tax (PBB) without taking into account the taxpayer’s personal circumstances. In many cases, the land being taxed may be inherited property that does not necessarily reflect the owner’s current economic capacity.