Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInvestment growth remains strong despite political uncertainty

Indonesia posted solid growth in realized investment for the first quarter of 2023 and has almost reached a quarter of the government’s full-year target, but some observers say the approaching election campaign could give investors pause.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia posted solid growth in realized investment for the first quarter of 2023 and has almost reached a quarter of the government’s full-year target, but some observers say the approaching election campaign could give investors pause, while simmering geopolitical tensions are another risk factor.

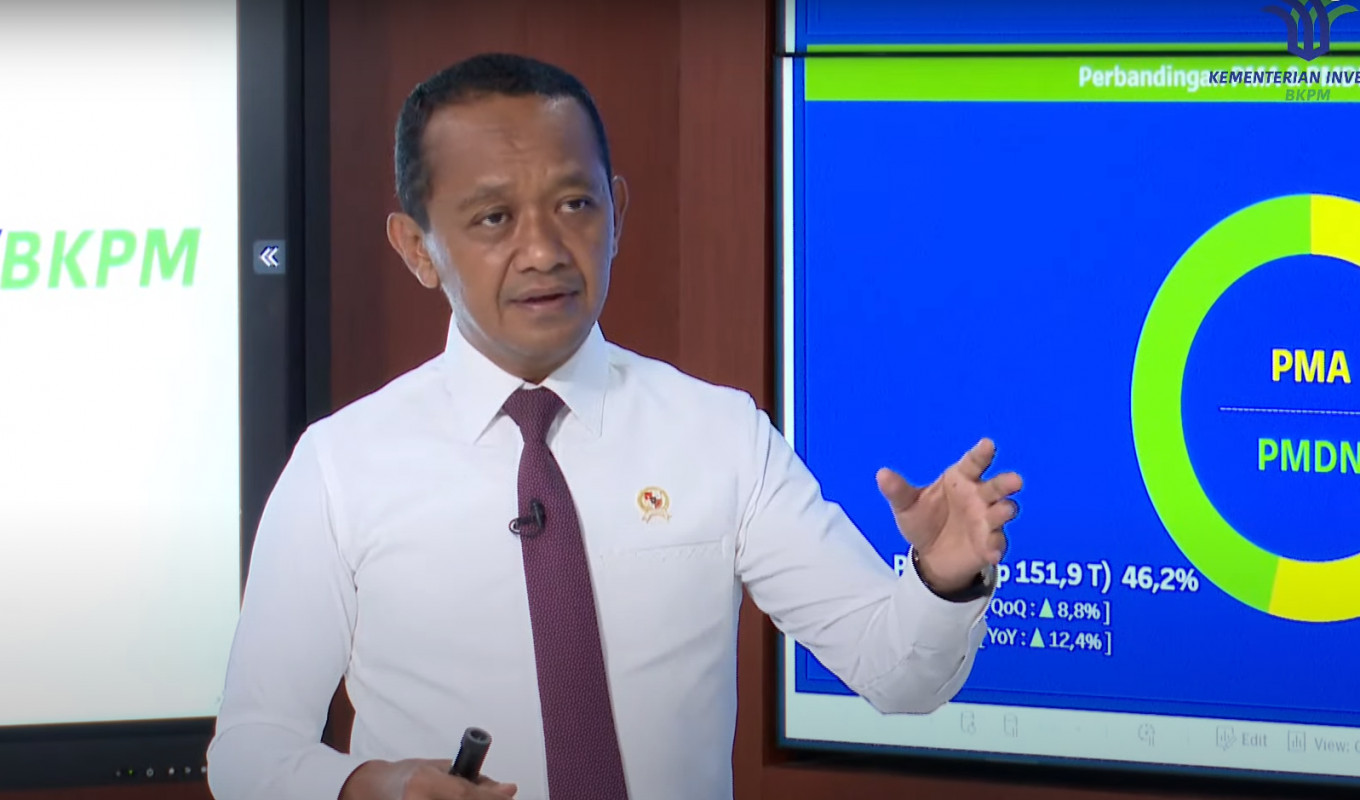

According to figures presented by the Investment Ministry on Friday, Rp 328.9 trillion (US$22.4 billion) worth of direct investment were realized during this year’s first quarter, which is 16.5 percent more than what was achieved in the equivalent three months of last year.

The year “2023 poses different sets of challenges, first and foremost because this is a political year, [which is why] many will play the wait-and-see card. And then, the geopolitical [situation], I have to say, is not in a good state,” Investment Minister Bahlil Lahadalia told reporters on Friday.

President Joko “Jokowi” Widodo has set this year’s investment target at Rp 1.4 quadrillion, raising the bar compared to last year’s goal of Rp 1.2 quadrillion.

The basic metals industry continues to account for the lion’s share of investment with Rp 46.7 trillion, or 14 percent of the total investment logged in the first quarter, followed by the sectors of transportation and mining, which attracted Rp 36.1 trillion and Rp 33.5 trillion, respectively.

Foreign direct investment (FDI) made up 53.8 percent of the first-quarter total investment, and most of it, namely $2.9 billion, went to the basic metals industry, followed by $1.2 billion poured into the transportation sector.

$1.9 billion of that FDI was channeled to Central Sulawesi, the province that holds most of the nickel wealth of Indonesia, which in turn has the world’s largest reserves of the silvery metal.