Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

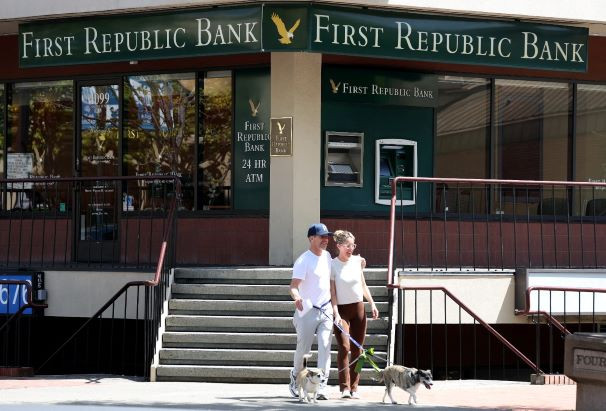

View all search resultsJPMorgan to buy First Republic after regulators seize control

Change text size

Gift Premium Articles

to Anyone

U

S financial authorities have taken possession of California's troubled First Republic Bank, which will be acquired by JPMorgan Chase, government regulators announced Monday in the latest banking failure.

First Republic, the second-largest bank by assets to collapse in US history, has been in freefall since disclosing last week that it lost more than $100 billion in deposits in the first quarter, causing its shares to plummet.

The San Francisco-based lender had been under heavy pressure after the bankruptcies in March of regional banks Silicon Valley Bank and Signature Bank sparked fears of contagion and rattled financial markets.

Officials have been scrambling to come up with a rescue package.

The US Treasury and the Federal Deposit Insurance Corporation (FDIC), an agency in charge of guaranteeing bank deposits, approached six banks last week to gauge their interest in buying First Republic's assets, a source familiar with the matter told AFP.

As part of the deal struck early Monday, the California regulator appointed FDIC as the receiver of First Republic, to be immediately sold to JPMorgan Chase.

On Monday, the 84 First Republic offices in eight states will reopen as branches of JPMorgan Chase Bank, according to the FDIC.

"To protect depositors, the FDIC is entering into a purchase and assumption agreement with JPMorgan Chase Bank, National Association, Columbus, Ohio, to assume all of the deposits and substantially all of the assets of First Republic Bank," FDIC said in a statement.

The federal regulator estimated it will cost about $13 billion to cover First Republic's losses.

The government's takeover and sale of the bank comes two months after the failure of Silicon Valley Bank, which led to a snowball effect as concerned investors looked for signs of weakness in the broader banking sector in the United States and Europe.

Another US regional bank failed in the aftermath of SVB's collapse, while the Swiss banking giant Credit Suisse became the highest-profile casualty a few days later when it was pushed by regulators to merge with its bitter rival, UBS.

Regulators on both sides of the Atlantic took swift action to stem the outflow of bank deposits by concerned customers.

With its assets standing at $233 billion at the end of March, First Republic is the second-largest bank to fall in US history -- excluding investment banks, such as Lehman Brothers -- after Washington Mutual's bankruptcy during the financial crisis of 2008.