Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

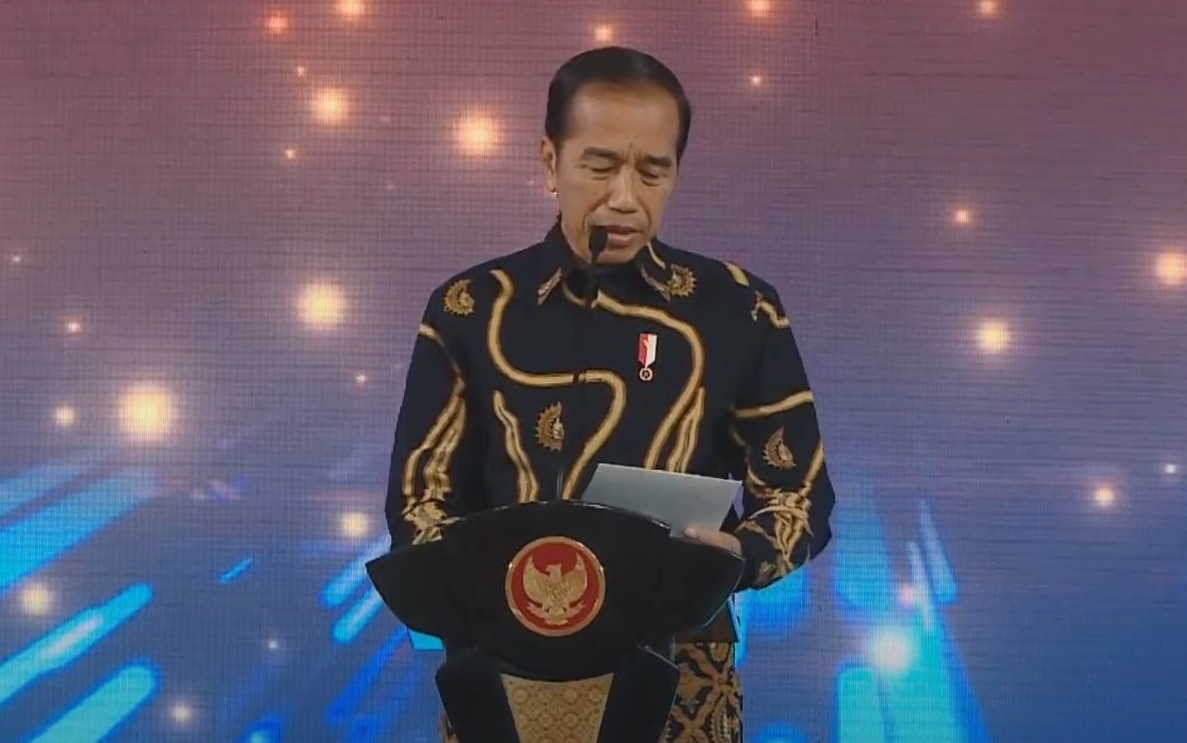

View all search results‘Don’t be too careful’: Jokowi urges banks to jack up loans for the economy

President Joko “Jokowi” Widodo has asked banks to not hesitate in giving loans to businesses, hoping this could help increase money circulation so it could boost the economic growth

Change text size

Gift Premium Articles

to Anyone

P

resident Joko “Jokowi” Widodo has asked banks to not hesitate in giving loans to businesses, hoping this could help increase money circulation and boost economic growth amid global uncertainty, but analysts said slow government spending is also to blame.

Speaking at the Bank Indonesia (BI) annual meeting on Wednesday night, Jokowi asked rhetorically if too much money was running into government and BI-issued bonds, therefore depriving money from the real sector, such as households and non-financial businesses.

“I heard from a lot of business players that cash circulation is drying up,” said the president, before proceeding to recommend that banks give more loans, especially for micro, small and medium enterprises (MSMEs), instead of buying bonds.

He said that being prudent is important for banks, before continuing to say: “but don’t be too careful”.

Jokowi began his speech by saying that Indonesia and many other countries must face the fact that ongoing wars such as those in Ukraine and Gaza are likely to be prolonged, implying that global economic uncertainty and supply disruption in many parts of the world will persist next year.

This year, Indonesia’s economic growth is expected to hover at 5 percent, below the 5.3 percent target set in the state budget, partly because of the aforementioned reasons.

Read also: GDP growth falls below 5 percent for first time since pandemic