Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

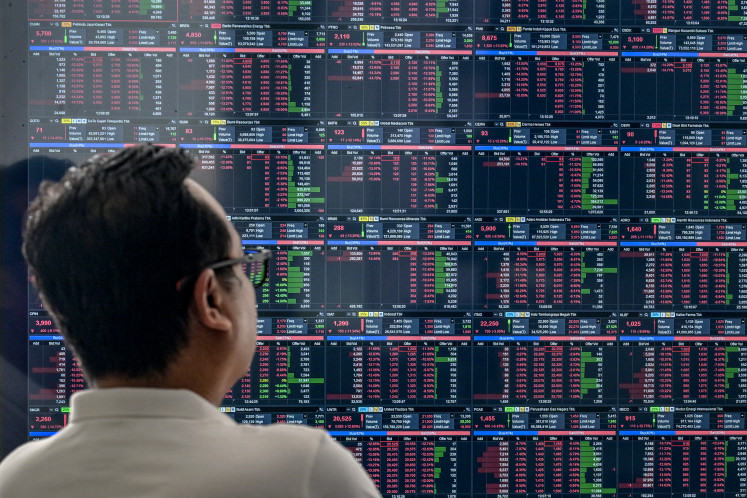

View all search resultsSouth Korea’s chip exports to China slow amid surge in Taiwan shipments

China and Hong Kong combined accounted for 61.6 percent of Korean semiconductor exports in 2020, but by the end of 2024, that figure had dropped to 51.7 percent, according to data from the Korea International Trade Association.

Change text size

Gift Premium Articles

to Anyone

S

outh Korea’s dependence on China for semiconductor exports dropped last year, while shipments to Taiwan and Vietnam increased, industry data showed Sunday.

The shift appears to be in response to wide-ranging global trends, including intensifying US-China chip competition, growing US demand for AI-related chips and the relocation of IT production away from China.

According to the Ministry of Trade, Industry and Energy, South Korea’s semiconductor exports reached a record $141.9 billion in 2024, a 43.9 percent increase from $98.6 billion in 2023.

By country, the share of shipments to China, traditionally South Korea’s largest market, has declined over the years.

China and Hong Kong combined accounted for 61.6 percent of Korean semiconductor exports in 2020, but by the end of 2024, that figure had dropped to 51.7 percent, according to data from the Korea International Trade Association. Breaking it down, exports to China fell from 40.2 percent to 33.3 percent, and to Hong Kong from 20.9 percent to 18.4 percent.

Much of the chip trade with Hong Kong is believed to end up as re-exports to China, further accentuating the drop in direct exports to the Chinese mainland.

Exports to the US have remained largely unchanged, from 7.5 percent in 2020 to 7.2 percent in 2024.

However, when considering the supply of high-bandwidth memory to US chipmaking giant Nvidia, which is manufactured in Taiwan, the effective US share rises when Taiwan is included.

Taiwan’s share of Korean chip exports jumped from 6.4 percent in 2020 to 14.5 percent in 2024, buoyed by surge of SK hynix’s sales of HBM to Nvidia through Taiwan’s TSMC.

According to industry sources, SK hynix’s HBM is shipped to TSMC, the global foundry leader, before being sent to Nvidia, which doesn’t manufacture its own chips. The Taiwanese firm packages GPUs with the HBM chips supplied by SK hynix to produce AI accelerators for Nvidia.

When combining the US and Taiwan shares, the export percentage rose from 13.9 percent in 2020 to 21.7 percent in 2024.

Vietnam’s share has also been on the rise, with its proportion rising from 11.6 percent in 2020 to 12.9 percent in 2024. This growth is largely attributed to companies like Samsung Electronics relocating their smartphone facilities from China to Vietnam. Samsung closed its Huizhou plant in China in 2019. The factory once produced 17 percent of the firm’s phones, but production was relocated to Vietnam and India. As a result, exports of related components, including semiconductors, have significantly increased.