Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsA glimpse into the future: The role of Islamic green financing

Multilateral development banks (MDBs) play an instrumental role in assisting their member nations' green economies, primarily through support to the implementation of their Nationally Determined Contributions (NDCs) and long-term climate initiatives.

Change text size

Gift Premium Articles

to Anyone

T

he grave implications of climate change and environmental degradation have pushed the need for a more sustainable economy to the forefront of public debate. Transforming our member countries' economies to be more sustainable requires substantial investments, notably to support their green and low-carbon transition.

Given that the public sector alone cannot meet these investment needs, solutions have been pursued to bring the private sector on board. Thus, green finance involves mobilizing resources to address climate and environmental issues (green financing), on the one hand, and improving the management of financial risk related to climate and the environment (greening finance), on the other hand.

Sustainable finance is an evolution of green finance, as it considers environmental, social, and governance (ESG) issues and risks to increase long-term investments in sustainable economic activities and projects.

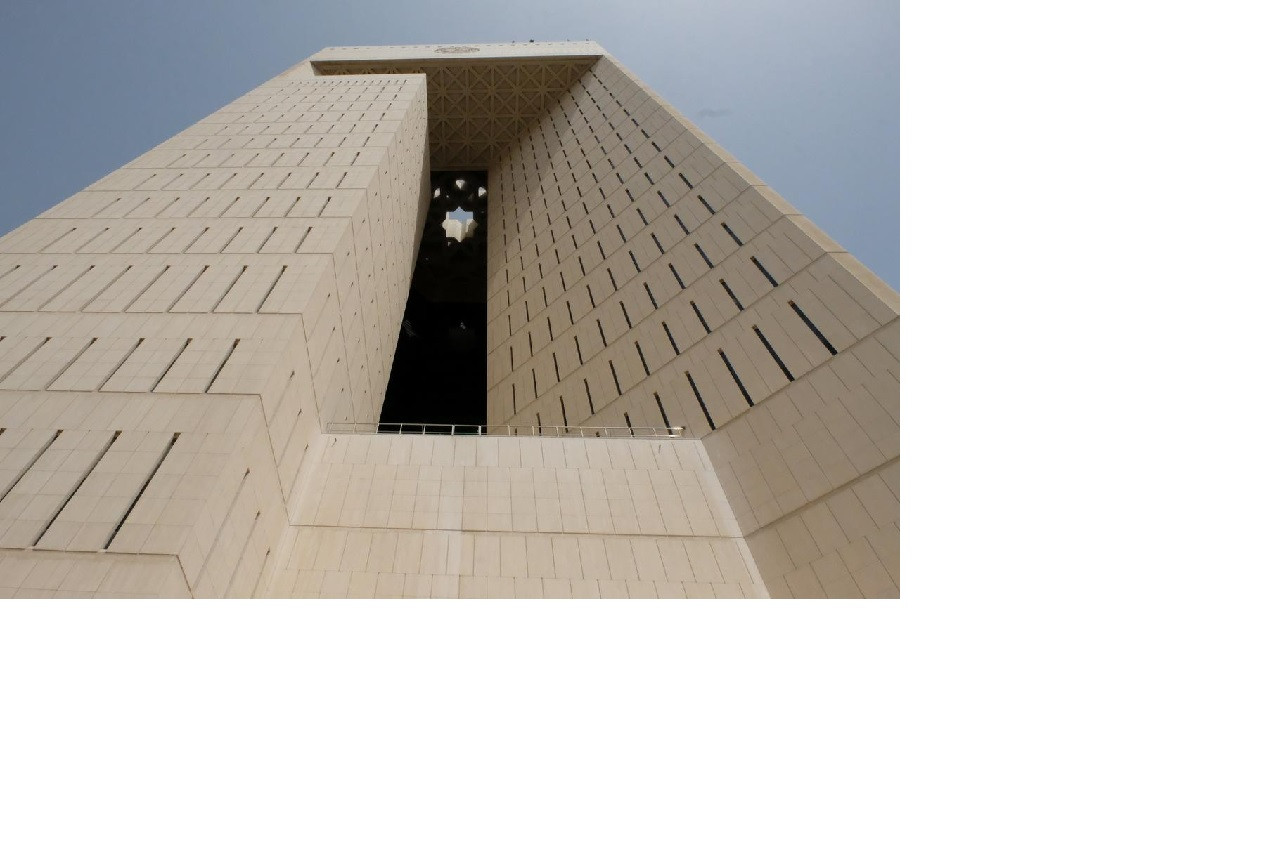

As one of the leading global players in Islamic finance, the Islamic Development Bank Group has strengthened its development strategy for member countries through a well-grounded Sustainable Financial Framework.

As part of our efforts to address the long-term effect of climate-related issues, we have launched a Sharia-compliant financial product known as green sukuk, which aims to sustain environmental and climate-friendly projects.

Green sukuk is a structured financial product shaped to ensure a better environmental outcome. It involves an array of financing mechanisms and investments employed to encourage the development of green projects or minimize the impact of other development projects on the climate, or a combination of both.

So far, the Bank has successfully issued a one billion-euro green sukuk (Islamic equivalent of bonds) in 2019 and a US$ 2.5-billion sustainability (for green and social projects) sukuk in 2021, the largest of their kind.

Multilateral development banks (MDBs) play an instrumental role in assisting their member nations' green economies, primarily through support to the implementation of their Nationally Determined Contributions (NDCs) and long-term climate initiatives.

However, we recognize the necessity to consider country circumstances and urgent development needs; hence, a just transition is critical. We must ensure that the substantial benefits of a green economy transition are shared widely while supporting those who stand to lose economically. As an MDB, we have developed a set of "shared principles" to guide our efforts for a just transition in our member countries.

Furthermore, the volume of financing and technical assistance necessary to fulfill the ambitious 2030 Agenda for Sustainable Development far surpasses the capabilities of individual countries and multilateral financial organizations.

To close the financing gap and implement the Addis Ababa Action Agenda policies and measures, the private sector's finances, capacities, and know-how must be mobilized within the Global Partnership for Sustainable Development.

An essential part of this drive is to better manage environmental and social risks, take up opportunities that bring a decent rate of return and ecological benefit, and deliver greater accountability.

Moreover, the inclusion of ESG factors in the investment decision-making process allows considering a broader investment area and strengthening financial stability by taking account of additional risks than just the environmental ones.

I call on all multilateral financial institutions to walk the talk to maintain the momentum of green financing and prioritize greener investment.

On the whole, the Islamic Development Bank's Sustainable Financial Framework seeks to unleash climate-friendly operations by availing financing models in tailored green projects in our member countries.

These green projects/assets will be utilized to back up the issuance of green sukuk to sustain the momentum of this "virtuous cycle" of greening the financial system.

***

The writer is president of Islamic Development Bank.