Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInsight: Fostering the role of peer-to-peer lending in the economy

Change text size

Gift Premium Articles

to Anyone

B

anking is still the main source of financial services for Indonesian consumers. The portion of banking credit in serving Indonesian consumers’ financial needs has reached 90 percent, while the remaining 10 percent comes from non-bank institutions such as finance companies, venture capital firms, pawnbroking companies, microfinance institutions and peer-to-peer lending (P2PL) financial technology (fintech) companies.

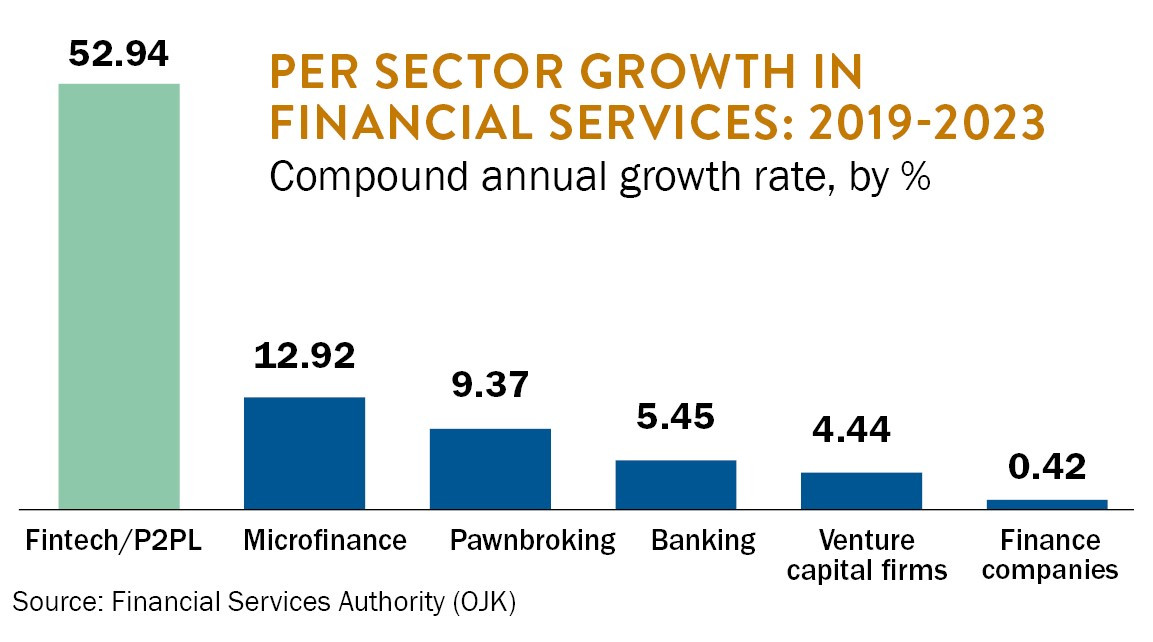

However, if we look at growth in each financial services subsector over the last five years, P2PL has the highest figure at 52.94 percent. This high growth reflects high interest from consumers in the services provided by P2PL platforms.

Why are P2PL services so popular in Indonesia? According to the research of several institutions, there are still many unbanked and underserved Indonesians, that is, they do not have access to banking services or have limited use of banking products. P2PL services are an alternative solution for members

of the unbanked community who need loans for both productive and consumptive purposes.

Fintech is a digital technology innovation in the financial services sector. P2PL is one form of fintech that has been developing very rapidly in recent years.

Read also: The future of Indonesia’s mobility: Will electric vehicles take off in 2024?According to OJK Regulation No. 10/POJK.05/2022 on information technology-based joint funding services, P2PL is the provision of financial services directly through a digital system using the internet to facilitate lenders and borrowers in carrying out conventional or sharia funding.

The government’s concern in developing the financial services industry, including P2PL, has manifested in the enactment on Jan. 12, 2023 of Law No. 4/2023 on financial sector development and strengthening (PPSK Law). Furthermore, the PPSK Law also strengthens the role and authority of the Financial Services Authority (OJK) in supervising the country’s financial services industry.