Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsUAE commits $10 billion for Indonesia’s SWF

Promised funds surpass those of Japan, Canada, United States

Change text size

Gift Premium Articles

to Anyone

T

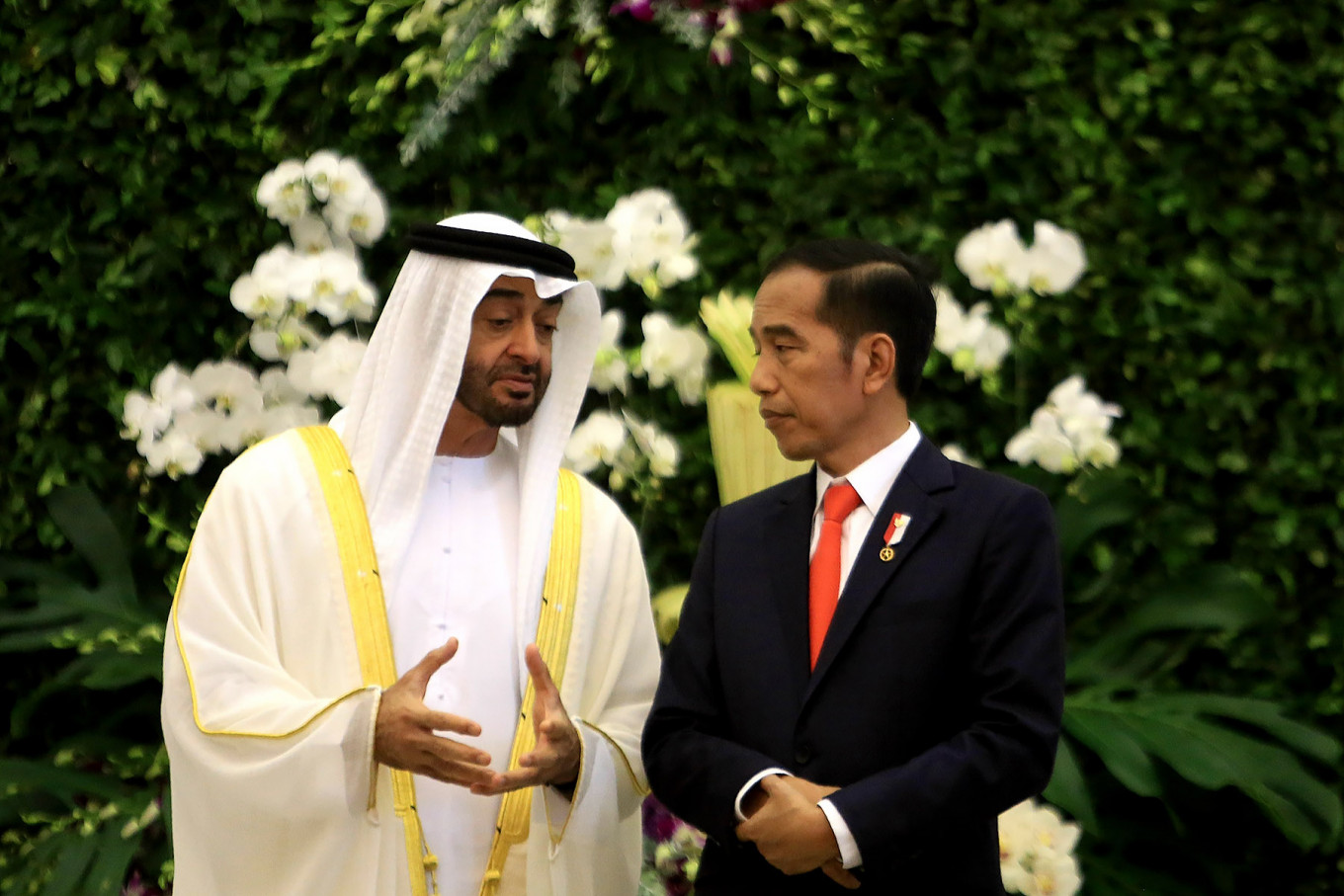

he United Arab Emirates (UAE) has become the largest anchor investor in Indonesia’s sovereign wealth fund (SWF) to date after announcing plans to inject US$10 billion at the directive of UAE Crown Prince Mohammed bin Zayed al-Nahyan.

Indonesia’s embassy in the UAE wrote on Tuesday that the Middle Eastern country’s promised funds outweighed those of Japan, Canada and the United States, among other big-ticket investors in the SWF. The funds will go to the Indonesia Investment Authority (INA), which is the SWF’s legal entity, to finance roads, ports, tourism and agriculture, among others projects deemed lucrative.

“We hope the INA will manage the funds to improve funding access for various development projects without accumulating debt, and implements international best practices and improves the performance and utilization of assets for the benefit of the people,” said Indonesian Ambassador to the UAE Husin Bagis.

The embassy wrote that the commitment had been finalized after President Joko “Jokowi’” Widodo had called Prince bin Zayed on Friday. It described the deal as the “sweet fruit” arising from the call.

The government has created the INA to finance domestic development projects, including the planned new state capital in Kalimantan, by pooling funds from development aid agencies, local state-owned enterprises (SOEs) and foreign investors, among other sources.

The government expects the fund, the legal foundation of which is the landmark 2020 Job Creation Law, to manage $100 billion in investment within two years and at least $20 billion in the next few months.

Read also: A different species of SWF

The previous most recent commitment by foreign investors to the INA was $9.5 billion on Feb. 8, according to Coordinating Economic Minister Airlangga Hartarto.

He said the investors were the US’ International Development Finance Corporation, the Japan Bank for International Cooperation (JBIC), Canadian pension fund Caisse de dépôt et placement du Québec (CDPQ) and Dutch pension fund APG-Netherland.

On Jan. 27, Jokowi inaugurated the five members of the fund’s supervisory board, namely Finance Minister Sri Mulyani Indrawati as chairwoman, SOEs Minister Erick Thohir and three professionals.

On Feb. 16, President Jokowi inaugurated the INA’s five-member board of directors led by seasoned banker Ridha DM Wirakusumah as chief executive officer.

“The setting up of the board is considered a turning point in the governance and development of the investment system in Indonesia,” wrote the UAE’s official news agency, the Emirates News Agency (WAM), on Tuesday.

The agency went on to say that UAE-Indonesia ties had “witnessed tremendous growth in recent years” following Jokowi’s visit to the UAE in September 2015 and bin Zayed’s visit to Indonesia in July 2019.

Read also: RI taps seasoned banker to manage wealth fund

Indonesian and UAE businesses signed several business deals during the business forum Indonesia-Emirates Amazing Week (IEAW) 2021 in early March.

The deals included those between arms manufacturers PT Pindad and Caracal International LLC, between oil giants Pertamina and Adnoc to trade gas and sulfur, between DP World and PT Maspion to develop a container seaport in East Java and between Murban Energy Limited and the Aceh administration to study developing new holiday islands in the province.

Oil-rich UAE is Indonesia’s largest Middle Eastern investor as investment inflows reached $21.6 million in 2020, one third of the $69.7 million invested the previous year, Investment Coordinating Board (BKPM) data show.

“I’m optimistic as to how much international investment is being attracted to the fund. We have seen that in the last forum,” said UAE Energy and Infrastructure Minister Suhail Al Mazroui at a press conference about IEAW 2021 on March 5.

He added that the Job Creation Law and its derivative regulations would help attract more investment to Indonesia.

The National Development Planning Agency (Bappenas) has estimated that the country will need $429.7 billion in infrastructure investment, equal to 6.1 percent of its gross domestic product, between 2020 and 2024, of which the government might only be able to cover one third.