Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia urgently needs law to regulate finfluencers

Many people have reportedly suffered losses from failed investments after following influencers' advice on social media platforms.

Change text size

Gift Premium Articles

to Anyone

T

he Australian Securities and Investments Commission (ASIC) released a new regulation on April 4 that banned financial influencers (finfluencers) from providing financial advice without a license on social media platforms such as Instagram, YouTube or TikTok. Failure to follow the rule could result in the influencer being sent to jail.

Australia is the first country to regulate influencers after being the first to adopt a regulation mandating media digital platforms to pay compensation fees to local news media outlets for displaying their content on their platforms.

The new ASIC regulation specifically states that a business is eligible for providing financial services if the owner holds an Australian Financial Services (AFS) license. Financial product advice may take various forms, including attempts to influence someone to purchase particular financial products.

While giving advice about financial services or promoting a particular product is strictly prohibited, advising on budgeting would not be considered breaking the law. Following the law, ASIC has taken influencer Tyson Scholz, who has 22,500 followers on Instagram, to court for delivering training courses and seminars about trading in securities without a license.

Financial influencers have significant power over the younger generation. Based on research conducted by ASIC, 28 percent of young people follow financial influencers, and 64 percent of them change their behavior because of a post on social media.

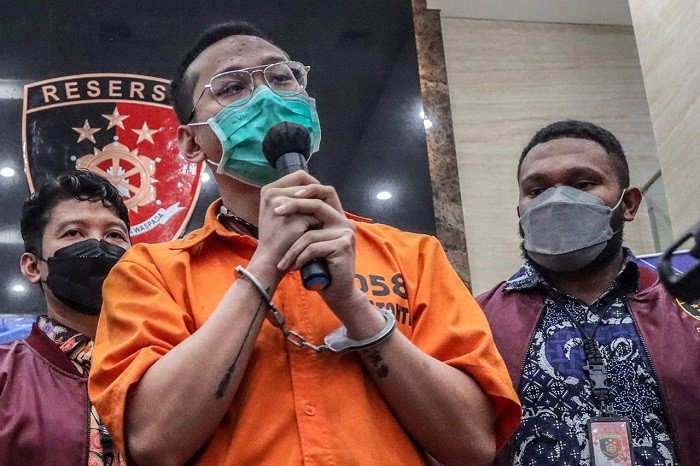

Influencers use social media to not only promote a product but also advise on nearly everything, from budgeting to choosing financial products. This includes promoting investment in specific stocks or assets with a promising return, despite many not holding licenses. Many display their luxurious lifestyles on Instagram and TikTok and credit their investing habits for their wealth, in Indonesia such influencers have earned the sobriquet “crazy rich”.

Australian influencers have had a mixed response to this regulation. Some have followed the new regulations by deleting several of their previous posts and unlinking products that they promoted. In contrast, others have complained that the rule is unfair to Australian influencers claiming that many Australians will seek advice from overseas information sources that ASIC cannot control.