Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsRiding the wave: Momentum in Indonesia’s plantation sectors

Indonesia’s CPO production is expected to improve, stabilizing export volumes, although they are likely to remain below historic levels of 26 million to 28 million tonnes.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s plantation sector has long been a cornerstone of its economy, contributing significantly to the nation’s export performance. In 2024, plantation commodities accounted for approximately 10.2 percent of Indonesia’s total export value, with crude palm oil (CPO) dominating the sector. Historically, palm oil has been the driving force behind Indonesia’s export success, but 2024 marked a challenging year for the commodity.

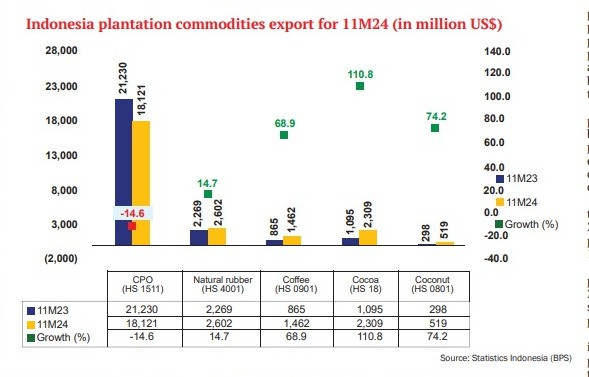

According to Statistics Indonesia, the export value of CPO (categorized under HS code 1511) experienced a sharp decline of 14.6 percent year-on-year (yoy), dropping from US$21.23 billion in November 2023 to $18.1 billion in November 2024. This decline was attributed to weaker global demand and competition from alternative oils. Despite this significant drop in CPO, the combined export value of all major plantation commodities saw only a moderate decline, showcasing the resilience of other commodities.

While CPO struggled, other plantation commodities such as coffee, cocoa, coconut and rubber demonstrated remarkable performances. Exports of natural rubber (HS 4001) grew by 14.7 percent, reaching $2.60 billion in November 2024, mostly driven by a surge in price and at the same time stable global demand in manufacturing and automotive industries. Coffee (HS 0901) exports surged by an impressive 68.9 percent, totaling $1.46 billion, fueled by rising global demand and better pricing conditions.

The standout performer was cocoa (HS 18), which more than doubled its export value, growing 110.8 percent year-on-year (yoy) to $2.31 billion. This surge was mainly supported by a significant increase in cocoa prices amid robust international demand for chocolate. Additionally, coconut (HS 0801) exports experienced significant growth, increasing by 74.2 percent to $519 million, reflecting rising interest in coconut-based products such as oil, water and other derivatives.

The plantation sector’s performance in 2024 highlights the mixed fortunes of Indonesia’s agricultural exports. Significant price increases for plantation commodities placed the sector under the global spotlight. Based on Bloomberg data, CPO prices rose from $837.9 per tonne in 2023 to $923.8 per tonne in 2024, with early 2025 prices reaching $1,045 per tonne. This price growth was driven by strong global demand, a significant drop in CPO inventory, especially in Malaysia, and an increase in demand for CPO in Indonesia's domestic market caused by the biodiesel program, which in 2025 will officially transition to B40 biodiesel mix.

Similarly, Arabica coffee prices increased by 36.8 percent yoy to $289 per bushel in 2024, while Robusta coffee prices surged by 71.6 percent yoy to $4,274 per tonne. Both experienced significant declines in global production, with El Niño affecting almost 60 percent of Robusta-growing areas in Indonesia. Cocoa prices experienced an unprecedented rise, skyrocketing by 148.8 percent yoy to $8,226 per tonne due to a 14 percent drop in global production caused by the cocoa swollen shoot virus (CSSV) disease, which has severely impacted Africa, the world’s largest cocoa-producing continent. Natural rubber prices also saw a 26.6 percent yoy increase, averaging $1.74 per kilogram in 2024, mainly due to a drop in production in Thailand.

Indonesia plantation commodities export for 11M24 (in million US$) (Statistics Indonesia (BPS)/-)