Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsJapan's SoftBank posts $7.8b annual net profit

Japanese tech investor SoftBank Group, a major player in the US Stargate artificial intelligence drive, on Tuesday posted a $7.8 billion annual net profit, its first in the black for four years.

Change text size

Gift Premium Articles

to Anyone

J

apanese tech investor SoftBank Group, a major player in the US Stargate artificial intelligence drive, on Tuesday posted a US$7.8 billion annual net profit, its first in the black for four years.

Global market rallies were a boon to SoftBank, which reaped gains from its investments in the likes of Chinese e-commerce giant Alibaba and US telecom firm T-Mobile.

Its 1.15-trillion-yen ($7.8 billion) net profit for the 12 months to March 2025 was up from a net loss of 227 billion yen in the previous financial year.

The company's earnings often swing dramatically because it invests heavily in tech start-ups and semiconductor firms, whose share prices are volatile.

Tuesday's result marked its first full-year net profit since the 2020-21 financial year.

The group's Vision Fund investment vehicle also saw the values of its stakes in TikTok operator ByteDance and South Korean e-commerce service Coupang jump.

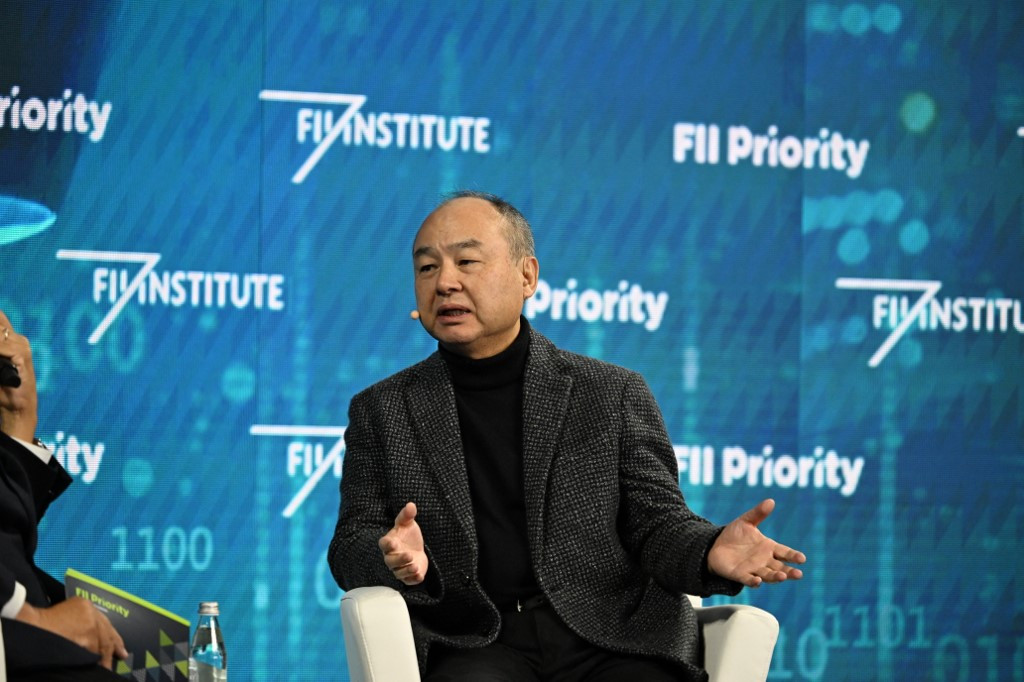

SoftBank has been betting big on AI under its flamboyant founder and CEO Masayoshi Son, who has repeatedly said "artificial superintelligence" will arrive in a decade -- bringing new inventions, medicine and ways to invest.

The company is leading the $500 billion Stargate project to build AI infrastructure in the United States along with cloud giant Oracle and ChatGPT-maker OpenAI.

But Bloomberg News reported this week that uncertainty fuelled by US trade tariffs has delayed financing talks for the project, citing people familiar with the matter.

SoftBank and OpenAI also announced in February that the Japanese giant would spend $3 billion annually to deploy OpenAI's technologies across its group companies.

SoftBank's Chief Financial Officer Yoshimitsu Goto told reporters that it enjoys strong ties with OpenAI and said trade tariffs should not hinder the group's operations.

In March, SoftBank said it had reached a deal to buy US semiconductor firm Ampere for $6.5 billion, reinforcing its aggressive push into AI. The purchase is expected to close in the second half of the year.

The Japanese company is a majority shareholder in Arm Holdings, whose technology is used in 99 percent of smartphones.

Hideki Yasuda, an analyst at brokerage Toyo Securities, told AFP ahead of Tuesday's announcement that he expected the firm to reveal strong figures.

"The market was not bad from January to March, so I think [the results] will land relatively well," he said.

"The market environment only worsened from the end of March to the beginning of April when the tariffs were announced," he said, referring to US President Donald Trump's multi-pronged free trade war.

Son, 67, made his name with successful early investments in Chinese ecommerce titan Alibaba and internet pioneer Yahoo.

But he has also bet on catastrophic failures such as office-sharing firm WeWork.

"For the last 20 years, the US market has been outstanding, so I don't think there was an option to not invest in the United States" for SoftBank, Yasuda said.

During that time the Chinese market was also growing, "so they invested in China -- but China has tightened up a lot of controls, so not much has been invested in China since then", he added.