Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsReviving ‘takaful’: Reflections on the Islamic New Year

The country's sharia insurance industry lacks optimal support from the sharia finance ecosystem and regulations, particularly in investment-related matters.

Change text size

Gift Premium Articles

to Anyone

The Islamic New Year observation on Wednesday was an opportune time to reflect on the principles of hijrah (migration) and their application in the realm of economics, particularly within the context of the growing sharia economy.

In Islamic teachings, hijrah is divided into two aspects. The first aspect, known as makaniyyah, relates to "place". An example of this is the migration of the Prophet Muhammad from Mecca to Medina. The second aspect is called hijrah haliyah, which pertains to changing behavior as a transformative process to strengthen faith and become a better individual.

From an economic standpoint, the changing behavior aspect of hijrah aligns with the global rise of the sharia economy, where the halal industry has emerged as a vital pillar of growth both globally and domestically. Projections from the Dinar Standard indicate that Muslims worldwide will spend up to US$2.8 trillion on halal products by 2025.

Indonesia, with its sizable Muslim population of 229.6 million in 2020, has the potential to lead the halal industry. The State of the Global Islamic Economy Report 2022 reveals that Indonesia's sharia economic indicators continue to improve, with the country ranking fourth globally. It is also one of the largest consumers of halal products, accounting for 11.34 percent of global halal expenditure.

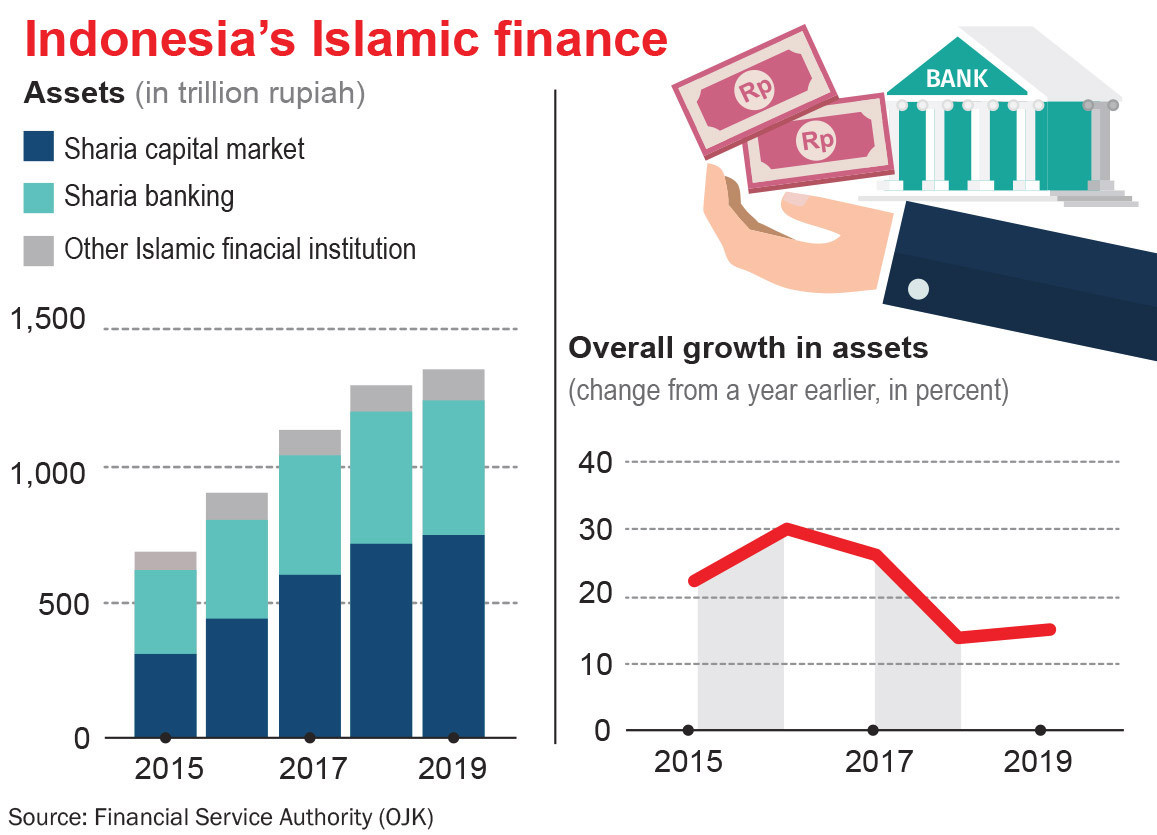

However, despite the significant growth in the overall sharia economy, the takaful (insurance) sector has faced challenges. In Indonesia, sharia insurance represents the smallest sector of the Islamic finance industry, comprising only 2.52 percent of its assets. While there are 15 full-fledged sharia insurance companies in Indonesia, there are 43 Shariah Business Units (SBUs) that still need to spin off by the 2024 deadline.

The performance of Indonesia's takaful industry, as shown by an IFG Progress study, has remained below that of conventional insurance, with total assets growing at a 1.8 percent compounded annual growth rate (CAGR) between 2018 and 2022. The sharia insurance penetration rate in Indonesia also remains low at 0.19 percent of gross domestic product (GDP), despite the country's Muslim population comprising 87 percent of the total population.