Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAspire strengthens presence in Indonesia with payment acceptance solutions

Change text size

Gift Premium Articles

to Anyone

A

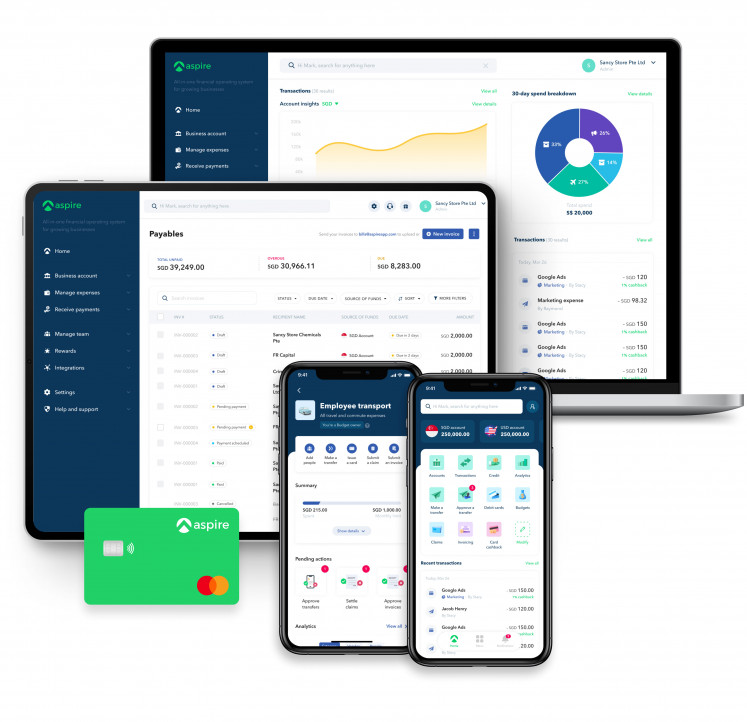

ll-in-one finance software, Aspire, has launched a new integrated payment acceptance solution in Indonesia. This underscores the Singapore-based fintech startup’s commitment to extending its solutions to local businesses.

This recent launch further strengthens Aspire’s software offerings. They now encompass a more complete suite catering to modern business needs. This includes expense management, account receivables management, and payment gateway solutions.

"At Aspire, our mission has always been to provide a comprehensive suite of financial tools on one interconnected platform. By eliminating money-related friction, we empower business owners with clear visibility over their finances. This allows them to streamline operations and save both time and money, helping them achieve their aspirations," stated Ferdy Nandes, general manager of Aspire Indonesia.

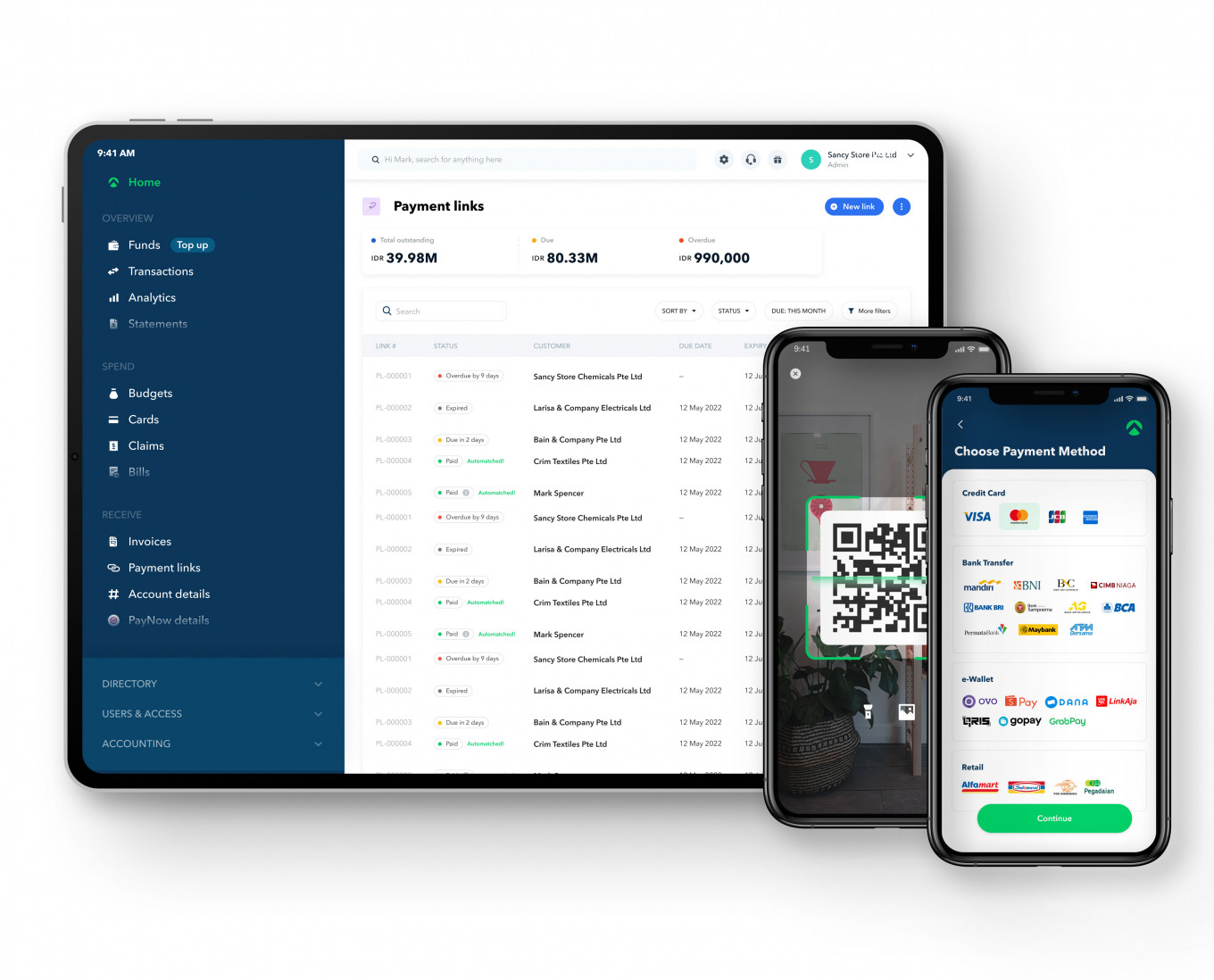

Aspire's payment gateway service can be integrated directly into client websites, applications, and other platforms to automate payment acceptance. Furthermore, Aspire's receivables management and payment link features allow clients to issue e-invoices and receive payments instantly. This enables businesses to accept and manage payments across various channels — from cards to virtual accounts, bank transfers, e-wallets, and even offline retail payments, all on one integrated platform.

These additional features cater to the evolving needs of a new generation of Indonesian businesses undergoing rapid digitalization. More than 5,000 businesses in Indonesia, including Haus!, ESQA, Buttonscarves, Halo Robotics, Avo, and Kopi Kenangan, have already partnered with Aspire.

The push towards digitalization in Indonesia is undeniable. Data reveals an impressive 11.5 percent month-over-month growth in e-money transactions in the first quarter of 2023.

"With Indonesia’s digital economy expanding at an impressive rate, there's a clear demand for reliable, integrated financial solutions," says Ferdy.

"At Aspire, we’ve always believed in tailoring our offerings to the unique needs of each market. We're honored to be a part of Indonesia’s digital transformation journey," he emphasized.

Aspire consistently places its clients at the heart of its innovations, showing its dedication to aiding in the digitalization of Indonesian businesses. The introduction of new 24/7 white-glove customer support stands as a testament to this dedication. Whether businesses encounter operational or IT issues, Aspire's robust support system ensures they receive immediate expert assistance.

"We don’t just provide tools; we act as a constant ally in our clients' digital journeys. Our round-the-clock support reflects this belief, ensuring businesses can navigate challenges swiftly and efficiently," Ferdy added.***

About Aspire: Aspire is the all-in-one finance platform for businesses, helping over 15,000 companies to save time and money through its international payments, expense management, payable management and receivable management solutions, accessible via a single, user-friendly account.

Headquartered in Singapore, Aspire has over 400 employees in four countries and is backed by global top-tier venture capital firms, including Sequoia, Lightspeed, Y-Combinator, Tencent and PayPal. Earlier this year, Aspire closed an oversubscribed US$100 million Series C round and announced that it had achieved profitability.